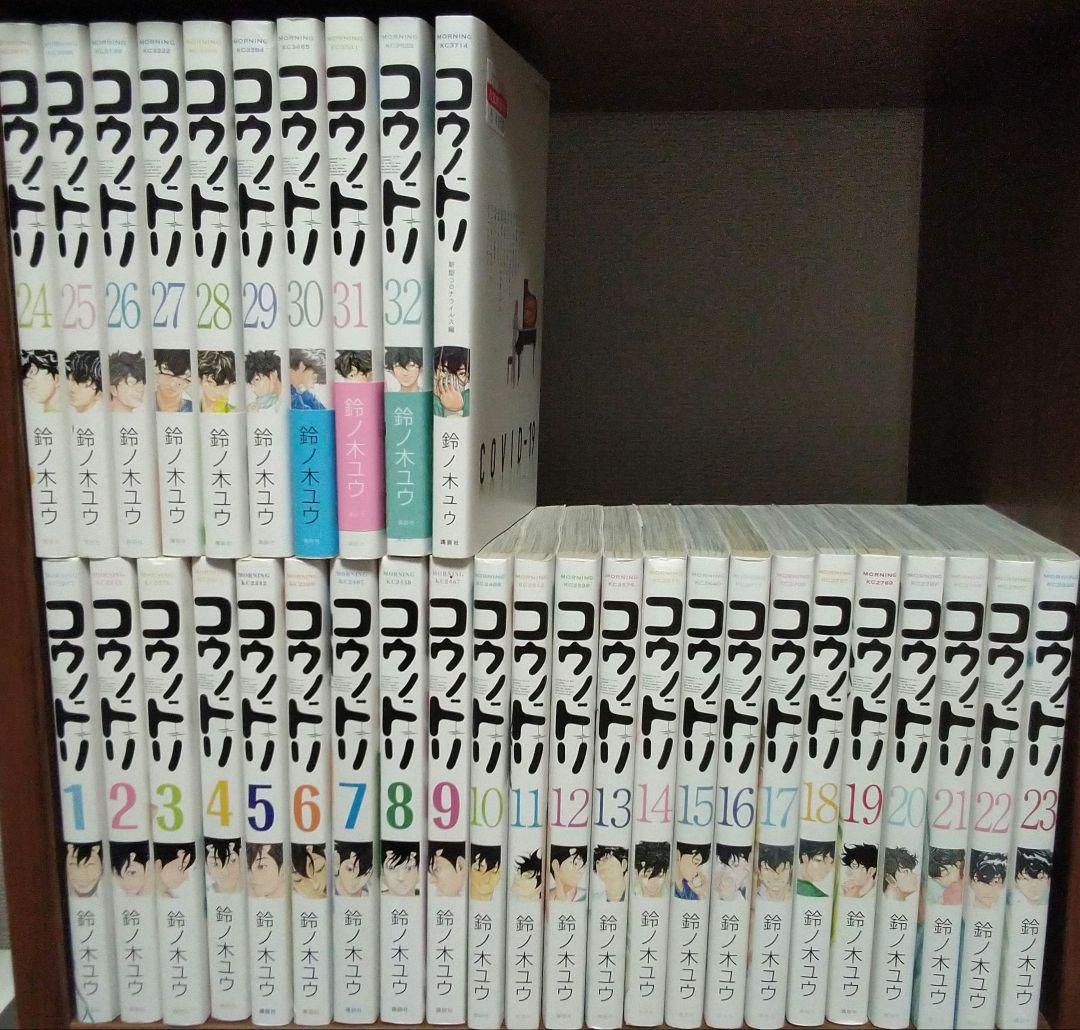

コウノドリ 全巻

(税込) 送料込み

商品の説明

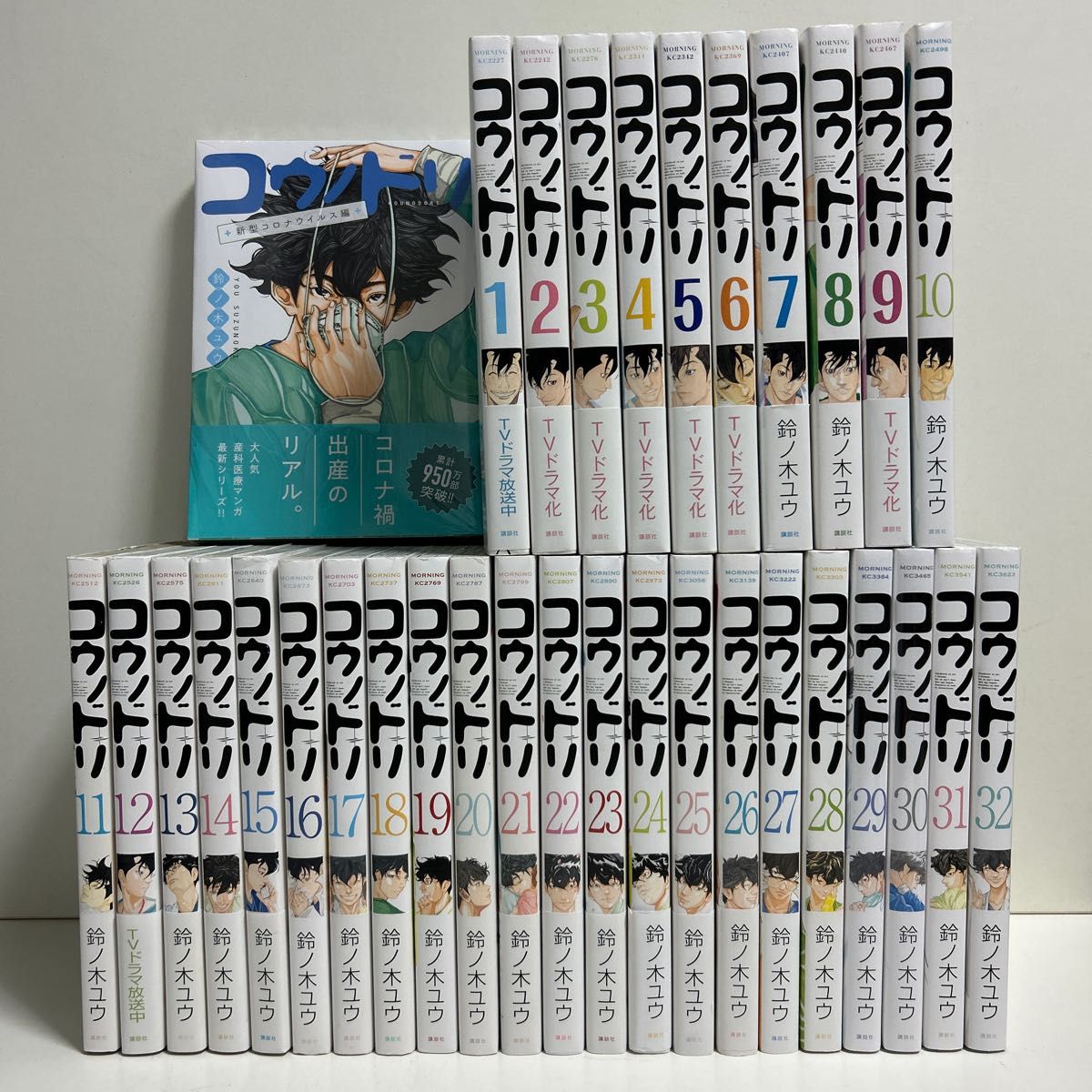

コウノドリ全巻 1巻〜32巻です。

帯付きです。(30巻のみ帯がありません)

数回読んだのみなので綺麗な状態です。

最後の写真のように18巻のみ少し傷があります。

ご理解ある方お願いします。

メルカリ便で配送します。商品の情報

| カテゴリー | 本・雑誌・漫画 > 漫画 > 全巻セット |

|---|---|

| 商品の状態 | 目立った傷や汚れなし |

コウノドリ全巻(全32巻)+新型コロナウイルス編 帯付き多数 鈴ノ木ユウ

コウノドリ - 全巻セット

再入荷 1〜32巻+1 コウノドリ 全巻セット - 全巻セット 1〜32巻+1

コウノドリ 32 冊セット 全巻 | 漫画全巻ドットコム

お買い得!】 コウノドリ 全巻 32冊 - 漫画

最安値挑戦】 コウノドリ 全巻セット 1~32巻+新型コロナウイルス編

海外輸入 コウノドリ 4冊 Amazon.co.jp: コウノドリ 全巻帯付き 漫画

即納可 コウノドリ 全巻 1~32 - 漫画

訳あり】 コウノドリ 全巻 セット 1~32巻セット | www.grupovirtus.es

海外輸入 コウノドリ 4冊 Amazon.co.jp: コウノドリ 全巻帯付き 漫画

注目ブランド コウノドリ 計33冊 コウノドリ 全巻32巻 鈴ノ木ユウ 漫画

期間限定30%OFF! コウノドリ全巻32+コロナ編1巻 コウノドリ 漫画

コウノドリ全巻セット+新型コロナウイルス編 - 漫画

作品 コウノドリ 全巻32巻 26冊帯付き 鈴ノ木ユウ | theartofspirit.be

ランキング1位受賞 漫画 コウノドリ全巻 ゆさま専用 コウノドリ全巻

即納・全国送料無料 全巻初版 コウノドリ 全巻 透明カバー付き 1〜32巻

特注加工 コウノドリ 全巻セット 1〜32巻 | chanelal.com

Amazon.co.jp: コウノドリ 全巻セット 1~32巻 鈴ノ木ユウ : おもちゃ

新発売 新型コロナウイルス編 コウノドリ 全巻セット 1〜32巻 全巻

直営店限定 コウノドリ コウノドリ全巻+新型コロナウイルス編 漫画

クーポン発行 コウノドリ 巻 セット 1~32 コウノドリ全巻セット 全巻

爆速黒字化 コウノドリ全巻(ほぼ初版) - 漫画

![セールの時期に安く購入 コウノドリ [全巻セット!] | de.uth.gr](https://static.mercdn.net/item/detail/orig/photos/m33636018862_1.jpg)

セールの時期に安く購入 コウノドリ [全巻セット!] | de.uth.gr

漫画「コウノドリ」全巻買ったらいくら?まとめ買いの最安値は? | 最

総合福袋 1~32巻+新型コロナウイルス コウノドリ全巻+新型コロナ

公式オンラインストア コウノドリ 全巻セット | chezspoons.com

日本未発売 コウノドリ全巻(全32巻セット)+新型コロナウイルス編 鈴ノ

買い公式 コウノドリ 全巻セット | www.afacarlit.cat

偉大な コウノドリ 全巻セット | www.grupovirtus.es

コウノドリ 全巻セット 1~32巻+新型コロナウイルス編 - 全巻セット

絶賛商品 コウノドリ 全巻 - 漫画

半額品 コウノドリ コウノドリ 全巻セット 帯付き 全巻 漫画 www

税込?送料無料】 コウノドリ 全巻 新型コロナウイルス編 | watchwatches.eu

楽天3年連続年間1位 コウノドリ 全巻 32巻+新型コロナウイルス編

秋田店 コウノドリ 全巻+新型コロナウィルス編 | medicalzonemangohill

お値打ち コウノドリ 全巻セット+新型コロナ編 | chezspoons.com

満点の やんなさん専用【裁断済】コウノドリ 全巻1~32巻+コロナ

コウノドリ 全巻セット+新型コロナウイルス編 - 漫画

スーパーセール コウノドリ 全巻セット 1巻〜32巻 漫画 www.community

正規流通品 コウノドリ 全巻32巻 | corporativo.cecomsa.com

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています